Panasonic Spin-Off Camera Manufacturer’s Growth Strategy

Representative Director, Chairman of the Board & Chief Executive Officer of i-PRO Co., Ltd.Masato Nakao

[Update] The new movie is ready to feature a dialogue by Masato Nakao (CEO, i-PRO Co.,Ltd.) and Professor Takahiro Fujimoto (Research Institure, Waseda University) Visit the page to play it!

Glory, Struggle, and New departure

On April 1, 2022, we changed our company name, from Panasonic i-PRO Sensing Solutions Co., Ltd. to i-PRO Co., Ltd., thus erasing the name of our original parent company.

But this name change is not just a transit point—it is a turning point that we should engrave in our hearts. I wish to take this opportunity to reflect on the path we have taken from our establishment until now and to outline our concept for the future.

Panasonic i-PRO Sensing Solutions was established as an independent entity from Panasonic on October 1, 2019. Of course, this change was not limited to a change of vessel, it represented a shift in purpose and strategy, the re-definition of our business field, re-connection of relationships, and reform of our organization. But it was just the first step in our long journey, and we continue to tackle these challenges today.

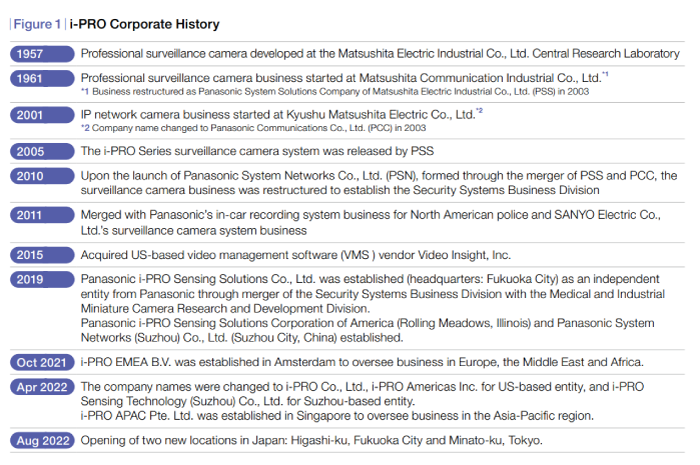

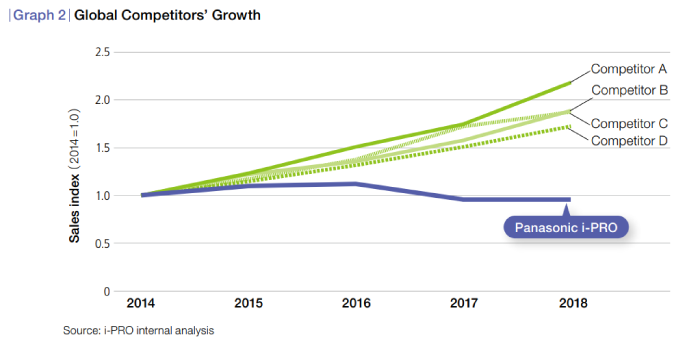

The origins of i-PRO can be traced back to 1957, when Matsushita Electric Industrial Co., Ltd. Central Research Laboratory developed a professional surveillance camera. Later, the company underwent mergers with Matsushita Communication Industrial, Kyushu Matsushita Electric, and SANYO Electric to become a world leader in the image sensing industry by the 1990s. (See Figure 1: i-PRO Corporate History.) But, in the global picture, we were slow in adapting to market changes. Although we still held a large share in the Japanese domestic market, we were falling behind newly emerged competitors in the global market. While global rivals were enjoying double-digit growth, our sales had remained at the same level for many years. (See Graph 2: Global Competitors’ Growth.)

We also saw a decline in our product development capabilities, which had been a source of pride since the Panasonic days. In fact, a survey conducted by an independent industry research institution in 2019 showed that we had also lost ground to our rivals in evaluations of camera performance. The key factor behind this was that they had redrawn the battle lines with new technologies and business models. Once a market leader, we failed to notice that our way of doing business was behind the times. People may say it was the success trap, and we must admit that this was why we could not break free from our conventional methods.

What was the problem? Here, I wish to reflect from the perspective of 3C: customer, competitor, and company.

The first point is the customer. Who exactly are i-PRO’s customers? Security systems are comprised of surveillance cameras and other hardware, along with software that performs tasks such as image analysis and system management. People known as system integrators design the systems, selecting the ideal hardware and software based on the client’s requests. Essentially, our customers are system integrators, and as a manufacturer, we should aim to improve our products and services in order to increase the likelihood that they will choose us.

But Panasonic as a whole was proclaiming a shift from products to services, changing course to become a solutions business. Its Security Systems Business Division, the predecessor to i-PRO, followed suit. We switched business models from simply supplying hardware to offering clients whole systems that included software. This put us into competition with some system integrators who should have been our customers.

Soon after i-PRO was established, our development division proposed a project to me to develop an advanced LPR (License Number Recognition) system. The aim was to compete with Japanese system integrators that supplied car park systems. Of course, these system integrators were not manufacturing cameras. In other words, they were potential customers. But we were not striving to encourage such companies to adopt our products, instead, we were trying to steal their business. There were countless such examples, resulting in many lost opportunities and utterly wasting our resources.

What were our global competitors doing? The late 1990s witnessed the global expansion of a digital revolution of IT and the Internet that spurred rapid acceleration of technological advancements. Based on this new business environment, our rivals opted to pursue horizontal specialization. Hardware manufacturers developed hardware, software developers focused on software, and system integrators concentrated on realizing client demands, each specializing in their own business field. Then, through collaboration, they were able to shrewdly target market opportunities. As a consequence, a new industry landscape emerged where a number of major players in video software management (VMS), the basis of security system platforms, and a few major camera manufacturers, had carved the market up between them. Unfortunately, we were not among them. From their perspective, it was difficult to collaborate with Panasonic, which offered clients a vertically integrated business of hardware and software.

In addition to the inconvenient reality that this business model created, we also had operations issues. Panasonic has a good reputation for manufacturing, with top quality products and production efficiency. But the price it paid to secure these merits was time. Global rivals had a new product development cycle of two to three years, in comparison with a four to five year cycle at Panasonic. Why so slow? The company would repeatedly refine designs in an effort to create the best product possible. But no matter how optimum a design is, in the world of digital, it takes just two years to fall out-of-date, making it impossible to maintain high appraisal for performance.

In addition, the company aimed to optimize production plans with the prerequisite of minimizing inventory. This frustrated customers by forcing them to accept long lead times. Rival companies, however, had sufficient inventory to be able to respond to customer demands for immediate delivery. The difference was clear in the eyes of customers. Soon after I joined the company, during a visit to a client in the U.S., I was shown the transaction screen for doing business with us, using electronic data interchange (EDI). I was shocked to see that the delivery time frame automatically displayed “90 days.”

In the past, the company won significant market share thanks to Matsushita Electric Industrial’s Panasonic brands, which guaranteed sufficient revenue. It had established sales channels, particularly in Japan, and had few rivals, allowing it to successfully operate the same business for almost 50 years. But the world viewed things more harshly. I think this is shown in the difference in speed seen in Graph 2, and in the third party’s product review. The company let its guard down—new rivals took advantage of this, and seized territory. The company had fallen into the success trap.

Becoming independent from Panasonic and changing our company name in preparation to re-launch is more than merely a change of name plaque. For a start, I want the new i-PRO to recapture the global lead that was carved out by our predecessors. Over the last few decades, our rivals have changed the principles of competition with business models that differ to ours, and have created new markets. This is why i-PRO will start at a disadvantage. We cannot beat our rivals with our current way of doing business, no matter how hard we try. We need to take up a new business model, as our rivals did previously, reform our principles of competition, and pioneer new markets. Our entire organization needs to deeply comprehend this, and each individual needs to personally reform their behavior.

In 2019, we immediately began to redefine our strategy. The new strategy we conceived is comprised of two main concepts. The first is an “open policy” and the second is “time-based competition.”

Open Policy

Open policy refers to horizontal specialization. i-PRO is a hardware manufacturer, specializing in development of hardware including cameras, our field of expertise. At the same time, in areas where hardware alone is not enough, namely, software and system integration, we share the work with our leading global partners.

Security systems are generally composed of (1) cameras and other hardware, (2) image analysis software such facial recognition (analytics), and (3) VMS, which controls the system. It is (4) system integration that executes optimal design installation based on the client’s wishes. During the time of Panasonic, we combined all four to create “solutions,” and aimed to provide all these aspects as “solutions” ourselves. But now, i-PRO focuses on position (1) as the reason for our existence, while strategically rebuilding relationships with partners who are responsible for the work of (2) to (4).

Since the establishment of i-PRO, we have actively endeavored to rebuild relationships with VMS vendors, AI analytics vendors and others. Our total sales for projects in collaboration with vendors other than Panasonic in fiscal 2022 are expected to be around double the level in fiscal 2019.

In this way, our open policy has become a driving force for i-PRO’s growth. In April 2022, we removed “Panasonic” from our company name and that has also helped us in re-building relationships with partners. From the viewpoint of major system integrators in competition with Panasonic, they were no doubt wary of purchasing cameras from a company with Panasonic in its name, even if we proclaimed an open policy. Fortunately, i-PRO still enjoys a strong reputation for product quality as a legacy from the Panasonic days, therefore many partners welcome our decision to remove Panasonic from the company name and our conversion to an open policy. We must be thankful to our predecessors at Panasonic who built up this valuable asset of reliable quality.

In fact, when I first proclaimed this open policy, I received many questions from within and outside of the company. There were people who questioned our decision to abandon the solution business, or who wondered if it was right to specialize in camera hardware at a time when AI was gaining attention as new solutions business. Obviously AI is a growth field that gets everyone’s attention. Describing one’s company as an AI solutions vendor is more in keeping with current trends and has a better ring to it than being a mere security camera manufacturer. I believe such questions are completely normal.

But I would like to respond to these questions by introducing the following story. California experienced a gold rush in the mid-19th century, with prospectors flocking in the hope of striking it rich, but who really became rich at that time? Was it James Marshall, whose discovery of gold sparked the gold rush? Was it one of the 49ers, who converged on California in 1849? The answer is none other than Levi Strauss. Strauss neither developed ground-breaking technology, nor lent a hand in prospecting. He merely made and supplied jeans made of thick, strong canvas. But because he took out a patent, which lasted 20 years from 1870, when he invented jeans, until 1890, he was able to benefit from his monopoly.

If we compare vendors who offer analytics and system integration using AI with the gold prospectors, we will aim to be like Levi Strauss. We will not compete with them in searching for gold. Instead, we will supply “jeans” in the form of AI-compatible cameras. In the same way that many ambitious people traveled west hoping to find fortune, there are now many players, big and small, clamoring to provide AI-based solutions. There are probably thousands, or even tens of thousands, of them now around the world. But there are few camera manufacturers with established technologies suited to the needs of the AI sphere, in the same way that there was once a limited number of jeans manufacturers.

It is said that around 60% of data used with AI is images. Essentially, the majority of openings into AI are camera-related, and cameras are therefore an essential tool for those working in AI. But can this be a source of profit in the way that jeans were? Some people claim that cameras are a commodity that anybody can make. To respond to that doubt, we must gain a hint from the strategies of our predecessors. It is at this point that we set our sights upon economies of scale. Do economies of scale function in the AI solution business, or the AI-compatible camera business?

Despite the market’s expectation, AI and its spread is not causing a stir globally. The fact is that it remains expensive. Unlike fields such as finance solutions and ERP, where standardization is advanced, AI solutions must be customized for each project. In other words, there is little standardization, therefore there is no room to achieve mass production that would engage economies of scale. We believe this situation indicates how extremely fragmented the AI market is.

When we consider the situation faced by AI engineers, in many cases, they must work on-site at the client company, and develop solutions through trial and error. If a camera manufacturer is able to work closely with such an extremely busy work site, AI will no doubt see progress, but unfortunately no such camera manufacturer exists. This is an issue for the AI market, but also a business chance for us. But to gain such a business opportunity, we must increase the variety of our AI-compatible cameras and be able to immediately supply even just single units. If we can successfully employ economies of scale here, we can be like Levi Strauss.

Everyone admits that AI is a growing market, but the pursuit of AI solutions does not afford opportunities to benefit from economies of scale. Because there is no maker in the world able to manufacture cameras in high-mix, low volume, with prompt delivery, the market is not growing as quickly as people hope. If i-PRO can establish a system for high-mix, low volume, and prompt delivery of AI-compatible cameras, the market will grow, we can become the default vendor, and expect exponential growth. This is the reason that we abandoned the solutions business to focus on manufacturing the hardware.

It is our second strategic concept, “time-based competition” that holds the key for establishing systems for high-mix, low volume, and prompt delivery. This way of thinking seeks to build competitive superiority through operational excellence. Let us look closer at the specifics.

Time-based Competition

We cannot reproduce the growth of Levi’s only through an open policy. i-PRO had many industry-first, world-first products, but rivals also continued to develop new products daily. Patents and technological innovation are short-lived, as we have entered an era of excessive competition and so-called engineered commodities (hi-tech everyday items). This is the exact opposite of the blue ocean enjoyed by Levi’s: a market known as a red ocean, that forces us into battles of attrition.

In order to break free of this red ocean, and build a competitive advantage, we devised the strategic concept of time-based competition. This is a strategy to maximize the value of time, aiming to differentiate ourselves from rivals and achieve our open policy. By combining these policies, we can supply products to anyone, while keeping the operational expertise, the source of our competitive advantage, an in-house secret, creating a situation that other companies cannot mimic. This operational excellence helps us differentiate ourselves from rivals, providing a stronghold to protect our profits.

The concept of time-based competition originates from a survey of global car manufacturers conducted by George Stalk, Jr., of Boston Consulting Group (BCG), which began with the exploration of the core competencies of the Toyota Production System and found that American makers took 60 months from development to launch of new models, which Japanese businesses achieved in 36 months.

The BGC survey showed that Japanese car manufacturers achieved higher growth than their US counterparts through improvements such as cutting inventory, reducing set-up time and interruptions, and improving workspace efficiency, whereby they boosted inventory turnover rates, along with equipment and labor occupancy rates.

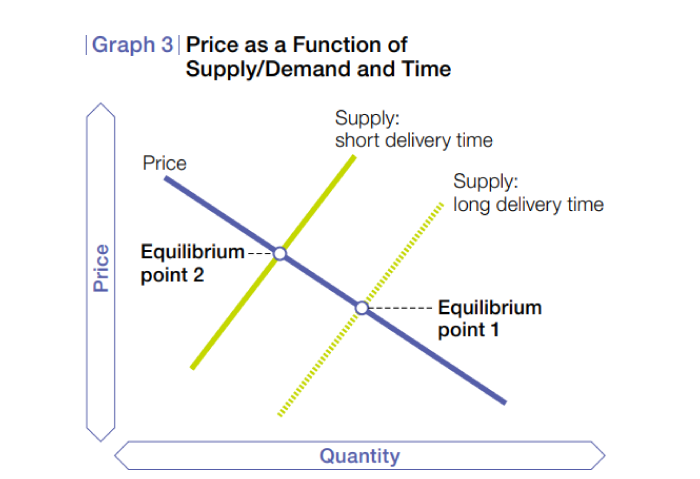

The crux of time-based competition is that time is a source of competitive advantage. Specifically, it is a concept of controlling time, for example, minimizing time that does not produce added value and cutting lead time, helping to reduce customers’ opportunity costs, justifying premium cost, and achieving profitable growth. For example, if products that take average of one week for delivery can be delivered the next day if a customer makes an urgent request, it is possible to charge more than normal, because six days of wait time are eliminated. In economic theory, price is said to be determined according to the balance between supply and demand, but when the variable of time is factored in, the position of the equilibrium point changes. If delivery time is long, it falls (equilibrium point 1), and if delivery time is short, it rises (equilibrium point 2). Basically, the relationship between supply, demand and price is greatly affected by time. (Graph 3: Price as a Function of Supply/Demand and Time.)

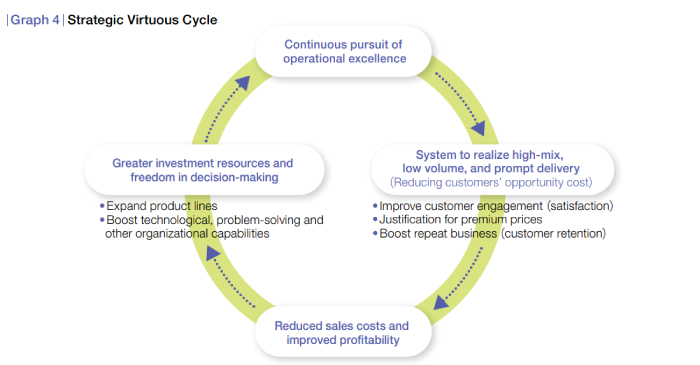

Operational excellence and process innovation are essential to make it possible to flexibly adapt to situations. Furthermore, a virtuous cycle based on such unique organizational capability functions as a barrier that prevents entry by rivals. (Graph 4 Strategic Virtuous Cycle)

A prime example of this is Misumi Group Inc. Originally a trading company, Misumi Shoji Co., Ltd., which sold die components, but it introduced a business model of catalog mail order sales, thereby establishing itself as a unique presence. Furthermore, by merging component manufacturer Suruga Seiki into its operations, it transformed into a SPA (manufacturing retailer) in the components business, and now produces as many as 80 sextillion (80 billion times 1 trillion) types of machine components, to order.

I would like to reflect upon and revise the nature of the camera as a tool. Professional photographers select the optima camera according to the subject they will photograph as well as the time, place and occasion. For this reason, most of them have a variety of devices. It is the same with cameras needed for AI. Diverse capabilities are required of cameras depending on the object and shooting environment, including angle of view, distance to the object, resolution, shutter speed, and depth of field. The construction of outstanding AI requires a one-of-a-kind camera that optimally combines these factors. In order to respond to such needs, we need the organizational capability for high-mix, low volume production and to leverage economies of scale.

The camera industry changed dramatically with the advent of the smartphone. Businesses have risen to prominence with sales in the millions per model, and there has been no sign of makers aiming for high-mix, low volume production. It is not necessary to work like Misumi in quantities of hundreds of quintillions, trillions or even hundreds of millions. Still, by introducing the same business model as Misumi and having customers purchase in the same manner, we should be able to achieve a presence that other companies cannot replicate. In other words, by continuing to pursue the value of time through operational excellence, we can escape the game of the red ocean where returns on investment in technological and operational innovations are unpredictable.

i-PRO’s time-based competition refers to the construction of operational excellence in the following two fields. The first is the engineering chain, that is, product development lead time; and the other is the supply chain, production and logistics lead time.

In the case of B2B products, many customers have different needs. In the time of Panasonic, we would prepare demand forecasts for these needs, and develop products in order of models we expected would be in greatest demand. But design and development rules were strict. We were required to develop the optimally designed product at minimal cost per model, without redundancy. As a result, it took a long time to make each model, and the number of products that could be developed each year was limited.

Also, a system of production, sales and inventory (PSI) planning was simultaneously implemented at the manufacturing front line. This was because we believed that the production of a large lot minimizes costs and optimizes inventory. It can certainly be considered a safe way to operate, but lead times tended to grow, and the supply chain lacked flexibility. Consequently, we lost opportunities here and there, for example, from being unable to promptly respond to changes in demand. Viewed from the perspective of time-based competition, our ways of development and manufacturing were in opposition.

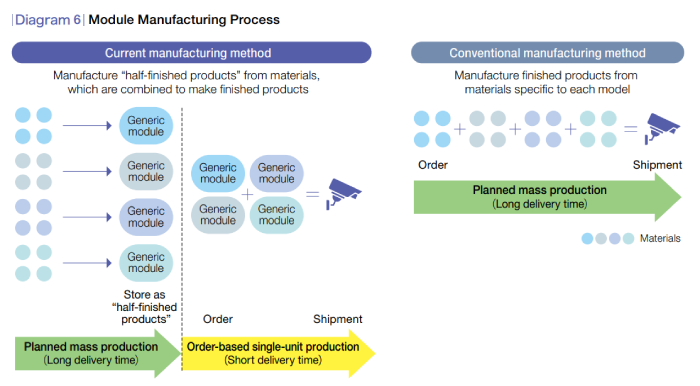

Even if we understood this, in the case of a large company with a long history, it is not easy to eradicate ingrained ways of thinking and working. Trying to resolve issues individually when they were complexly intertwined would end in an impasse. Resolution required not individual prescriptions but a general notion to liquidate the series of issues in one go. In the case of i-PRO, this was the modular concept. A restaurant is the epitome of this. Usually, restaurants have a large selection of items on their menu. Some restaurants prepare dishes from their ingredients at the time of ordering, but usually, they prepare items in advance, such as soups and stocks used in multiple dishes, and pre-cook meat and fish to save time. In production terminology, they are referred to as half-finished products. Fast-food chains and the like have a large selection of dishes, prepare half-finished products in advance and have processes to fix prepare finished dishes with minimal effort whether for an individual serve or a large order, thereby reducing the time required to fill customers’ orders.

In 2020, we revised the tailor-made system, the way we design a finished product from scratch, that we had used continuously for decades and began development of half-finished products. Essentially, we do not develop finished products, but switched to developing modules (general purpose half-finished products) for use in various types of products.

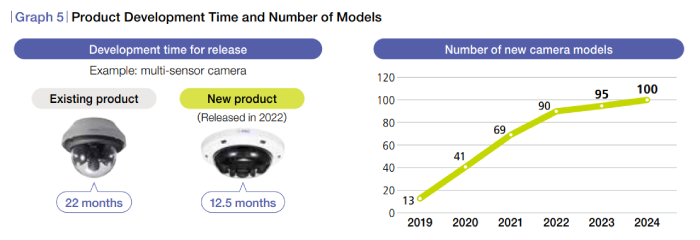

Actually, module design has a greater degree of difficulty than designing from scratch, model by model. This is because it is necessary to design to respond to diverse needs while minimizing redundancy, and to consider how to guarantee maximum compatibility between modules, for example. If you develop multiple modules with a high degree of versatility, it is possible to define all final products as a combination of them. The effectiveness of this is clear: the development cycle for one model is significantly reduced, and the number of new product models that can be released each year increases greatly. (Graph 5 Product Development Time and Number of Models) In the fast evolving digital industry, development cycle speed has greater significance than product range. This is because, by constantly incorporating the latest sensors and semiconductor chips released by suppliers into products faster than other companies, it is possible to retain the lead in product performance.

In the manufacturing front line, we mass produce these general-purpose modules to leverage the economy of scale, and retain them as inventory. We await orders with half-finished products, then quickly assemble and ship in response to demand, enabling us to immediately respond even to small-volume needs. This is also known as mass customization. (Diagram 6 Module Manufacturing Process) By delivering on customers’ requests in a timely manner and quicker than rivals, we can justify premium prices and also develop closer relationships with our customers. Then we can gain increased repeat business and customer life-time value (LTV) will increase.

Misumi succeeded in achieving rapid growth through its own unique business model but we can probably say that the key to its predominance is design expertise in generic modules (which Misumi refers to in-house as “blanks”.) The company has accumulated know-how in the degree of redundancy possible, and how much they can increase the final number of models, how many items should eventually be defined as blanks, which blank should be designed and manufactured in what way, how much inventory they should have, and so on. It goes without saying that it would be extremely hard for other companies to imitate them. Unlike product performance, it is not possible to see the engineering chain or supply chain from outside. Therefore, if you construct such a system, other companies will be unable to copy it, and you can maintain a competitive advantage. This is what i-PRO aims to do.

Medical Vision Strategy

Next, I would like to discuss i-PRO’s medical vision business. Currently, the medical vision business accounts for around 15% of total sales. i-PRO medical-use cameras are incorporated into rigid endoscopes and so on used for abdominal surgery and examination, and have been adopted by many major medical equipment manufacturers. The business is expected to grow even more in the future. Medical camera users have high expectations for aspects such as color reproduction, and their needs differ to those for security cameras. In addition, laws and regulations relating to medical treatment differ between countries, and needs vary by medical specialty, resulting in a more fragmented market than for security cameras.

To date, we have entered into individual agreements with major global medical equipment manufacturers and conducted joint development for medical-use cameras. Because specifications vary between manufacturers, it is necessary to develop based on those respective requirements. Consequently, as with security cameras, we took time to design and develop products, from optics to image processing. In principle, cameras developed with one customer cannot be used by other customers. For that reason, although we possess high-level technologies, during our time with Panasonic we were only able to work in markets controlled by major medical equipment manufacturers and were not able to access diversified long-tail segments.

But at the start of fiscal 2022, this business division also adopted the modular concept, switching to a development policy aimed at swiftly responding to dispersed needs by combining generic modules. Through our experience to date, we have accumulated vast quantities of data in-house related to client needs. We have sufficient knowledge of common needs and of needs that vary by client. Consequently, we can predict the extent to which we can meet diverse needs by developing generic modules. This is another area where we have an advantage over rivals.

By introducing the modular concept that supports our open policy and time-based competition, the medical vision business is now able to make diverse proposals faster than other companies. It represents a switch from a contracted manufacturing model to an OEM model. Based on this, the medical vision business is forecast to double its sales in the next five years.

A Future Created through “Open Policy” and “Time-based Competition”

As I explained earlier, our open policy and time-based competition, two strategic concepts that initially appear unrelated, become closely inter-related and are simultaneously realized through the introduction of the modular concept.

For i-PRO, our current aim is to reclaim the lead position in the security camera industry, which Panasonic once held. Again, since we began on our independent journey, we have renewed our relationships with leading global VMS vendors who now consider us one of their most important partners. At the same time, the number of system integrators worldwide that use i-PRO cameras has increased by 50% compared with 2019, and system integrators who were rivals of Panasonic are starting to use i-PRO cameras. In a few years, I expect we will be able to reclaim our former lead.

But I will not be satisfied by that, because it will only signify a change in the industry hierarchy. We aim for market creation through business model innovation. The built-to-order (BTO) model started by Dell Technologies brought a new wave to the PC industry. This is referred to as the Dell Model—they can provide various customization because they introduced a modular concept before others. i- PRO’s new business model also adopts this modular concept.

What then is happening in the AI industry? Humans are said to obtain 60 to 80% of their information through sight. In the same way, 60% of the information used by AI as material for analysis is image data. By our estimate, potential demand in the AI camera market for industrial use alone is worth around 400 billion yen. As I mentioned earlier, all cameras used for AI should be unique; the required specifications and performance differ depending upon the target. Cameras have many variables that should be optimized, including angle of view, distance to the object, resolution, shutter speed, and depth of field. But there are no manufacturers anywhere in the world that customize cameras for each user. Therefore at present, users have only two options—either pay a fairly high price to have them customized, or compromise with a standard camera available in the market. The AI market is extremely fragmented, and although cameras lie at the core, there are none that can meet such diverse needs. This is where i-PRO fits in.

i-PRO has a record in imaging technology with cameras for surveillance and medical use, and we have already expanded this technology to generic modules that we can assemble like building blocks. Essentially, we can build BTO cameras, like BTO PCs. In addition, we can flexibly adapt to user needs, for example, processing AI images on a server or the cloud, or using edge devices installed in the camera body. In the near future, there is likely to be a shift towards edge computing where cameras themselves feature AI instead of needing to send images to a server or the cloud. In this case, demand for i-PRO will grow even more.

i-PRO’s BTO cameras are derived from modules developed for surveillance and medical cameras. Through operations honed with time-based competition, we will be able to provide low-cost items in a short delivery time from just one unit. We began sales of such camera modules on a test basis in June 2022, through Amazon Japan websites. Users can also easily download the software needed to control the cameras and to analyze images. After you unpack the product and connect it to a PC, you can immediately begin image AI experiments. If it does not work as hoped, the user can replace the lens, sensor and/or interface and try again. We will gradually increase the number of modular items, expanding our range to respond to diverse needs. For engineers forced to work on-site at the client company, developing solutions through trial and error, BTO cameras are sure to be a savior.

The leading actors in the AI market, in addition to AI ventures, are engineers and programmers, including students and tech geeks. i-PRO wants to create a new market for BTO cameras and promote the advancement of AI by supporting such people. In 20 years’ time, even in 10 years, we hope people will mention us when looking back on their programming or AI industry experiences. This is our dream.

The leading actors in the AI market, in addition to AI ventures, are engineers and programmers, including students and tech geeks. i-PRO wants to create a new market for BTO cameras and promote the advancement of AI by supporting such people. In 20 years’ time, even in 10 years, we hope people will mention us when looking back on their programming or AI industry experiences. This is our dream.

Becoming a True Global Company

i-PRO’s strategy should be realized on the global stage. In fact, overseas sales have grown to 60% of our business, and our major rivals are global manufacturers. Next, I would like to discuss our management base for achieving victory over our global competitors. When we speak of a management base, it refers to both “brains” and “brawn.” “Brains” describes the information system, which is tied to finances, “brawn” describes our organization and human resources.

To support our “brains,” we replaced the old system inherited from Panasonic with a world-standard ERP package. We had only 18 months to complete the migration process. This created many challenges, but the work was completed in September 2022.

When we were a business division of Panasonic, we only represented a minor contribution to the group’s overall sales of eight trillion yen. In other words, for Panasonic as a whole, i-PRO was no more than a cost element. Consequently, in regards to financial accounting, all we had to do was to report once a month in the designated format to the parent.

But after becoming an independent company, the speed and granularity required for accounting functions has completely changed. We need to know day-to-day accounting information in minute detail and in real time, such as revenue for each product and client, individual inventory levels and out-of-stock items.

For this reason, we introduced a world-standard key information system, and are driving initiatives to significantly improve the quality and speed of our accounting processes. In regards to improving the quality, we hired a global cost controller to manage cost efficiency for the various expenses, labor costs, IT-related costs and so on throughout the value chain, from procurement through to manufacturing, logistics, warehousing and sales. Regarding speed, we are building a data warehouse (DWH) and leveraging business intelligence (BI) to enable each business division to act efficiently and effectively. We also use cloud services for approval work flow, expense management with the aim of conducting these more efficiently.

In our time with Panasonic, staff from the accounting division were dispatched to business divisions to provide accounting support. At i-PRO, we still follow this convention, with a team of “Finance Business Partners” formed directly under CFO. The team members attend meetings of each division to deepen their understanding of business activities, whereby they can more deeply scrutinize financial data, spot signs of risks and promote countermeasures, notice strategic opportunities and initiate action, and occasionally provide advice and consulting to new businesses.

At the same time as reforming our “brains” we are also driving reform of our “brawn.” In the time of Panasonic, we appeared much like a traditional Japanese company, with a corporate structure where the Japanese entity formed the backbone, and overseas subsidiaries were positioned as overseas sales companies. The consequence of this was that feedback from overseas subsidiaries was downplayed as mere information peculiar to that region, and little attention was paid to it. The core information was shared mainly in the Japanese language among trusted Japanese colleagues. With such homogeneous organizational behaviors, we were unable to immediately detect global changes in the industry structure.

Having reflected on this, we reconsidered our organizational structure from square one. We discarded the idea of a Japanese headquarters and overseas sales subsidiaries, revising our organizational structure to transcend borders, considering how to optimize i-PRO’s structure, comprised of over 1,300 people worldwide. Now, our officer responsible for global development in the surveillance camera business is based in the United States, the key global market, from where he directs Japanese R&D team. The business leader for medical spectroscopy cameras is an American based in the United States, to whom those responsible for the business in each country report.

They say that the organization follows strategy, and in the same manner, the first task that the CHRO set to address was building a common global human resource system so that we could reform the organization quickly to respond to changes and revisions in global level strategies and tactics. For this, we introduced an integrated human resources system called Workday to operate our grading, evaluation and compensation systems globally. Because of this, we can plan and evaluate personnel under the same criteria, even in cross-border organizations.

At i-PRO, we employ officers responsible for IT, finance, and human resources who accept diverse values and who understand global standards. Reform of our brains and our brawn is naturally accompanied by pain, but we drove reform through collaboration between talent from the old Panasonic, who are very familiar with the business, and new talent who understand the global standard management base.

i-PRO’s Professionalism

In order to reform the organization, it is not enough to only reform the “hard” aspects of organization design and the human resources institutions and systems. Our mission is to “Do our best for those professionals who create a safer and more peaceful world.” In order to understand the thoughts and feelings of such professional customers, it is necessary for every member of the i-PRO team to be a professional.

The root of the word “professional” is said to be the Hippocratic Oath, under which doctors in Ancient Greece were required to “profess” (swear) to the gods. The oath included aspects of the ethics and attitudes expected of a person who engages in medicine, such as sharing knowledge without reservation, not discriminating by gender or status, and ensuring not to leak patient information. But the most important that we should note is prioritize the benefit of the patient. In the same way, the only thing that a professional should prioritize is benefit to the customer.

What is the nature of a professional’s work? At i-PRO, we believe the work of a professional is comprised of four elements: to pursue specialized skills, to exercise leadership, to provide support and assistance, and to hand down specialized skills to the next generation. It is acceptable for a professional to specialize in and pursue just one of these elements, or to strengthen multiple elements. We recommend that employees decide by themselves what kind of professional they aim to be and devote themselves to that.

Even if their roles are different, one common aspect that is required of these four elements is to consider your own intention and act upon it, and to have the humility to accept the evaluation of others (360 degree evaluation). While we ensure the discretion and freedom of the individual in this, we must caution against egoism and expect moderation and discipline, always remembering consideration and support for others. While some believe in the market value of human resources, i-PRO aims to be a collective of high market value professionals.

We strive to redesign our human resources system based on the idea of fairness in order to nimbly activate our professional collective. This of course includes gender-based discrimination, but also age, nationality, race and other such differences. Recently, people are calling for the need for diversity management, but this is a given in a professional organization. Under our mission, whether it be myself, the CEO, or a young new hire, all of us are equal. There should be no peer pressure or hierarchical deference. It is essential that we establish a fair human resources system to guarantee an organization without such deference.

To this end, we must challenge Japanese commonsense and customary practice. For example, we took the scalpel to the mandatory retirement age system. In the time of Panasonic, there was a system where, upon reaching a certain age, employees were stripped of their managerial position and their remuneration was cut considerably. This system is typical in Japan, but such an arrangement contravenes a major rule of a professional organization that employees should be granted opportunities according to their abilities and motivation and compensated according to their contribution. We revised this system of managerial position age-related retirement, to a system that determines rank according to ability and motivation, regardless of age, and bases remuneration on evaluation of contribution. As it is, Japan is the only advanced country with a mandatory retirement system.

We also changed our policy towards non-regular employment. In principle, we believe that discriminating against non-regular employees contravenes professionalism if someone has the same ability, motivation and makes the same contribution as a full-time employee. This is a reflection of the values characteristic of a professional organization of meritocracy.

We are also implementing a program known as i-PRO - Building the Future (BtF) that promotes reform not only in the area of systems but also in awareness. We provide opportunities for discussion by all employees, regardless of affiliation or position. For example, we convene monthly forums for free and original discussion, including “I love i-PRO Products!,” where we discuss i-PRO products, and another where we discuss and learn about career and personal growth. I also lead a forum called “Strategy Sticky Note Room,” a monthly symposium where I explain our strategic intentions to employees. The idea for this Strategy Sticky Note Room was my memories of writing business strategy ideas on sticky notes and sticking them all over the conference room wall when I was younger.

Each of these BtF forums, which emphasize speaking out, regardless of content or eloquence of expression, are much appreciated by participants. There is no doubt that such ongoing positive experiences outside of the workplace lead to people taking proactive action naturally, and nurture a sense of oneness within the organization

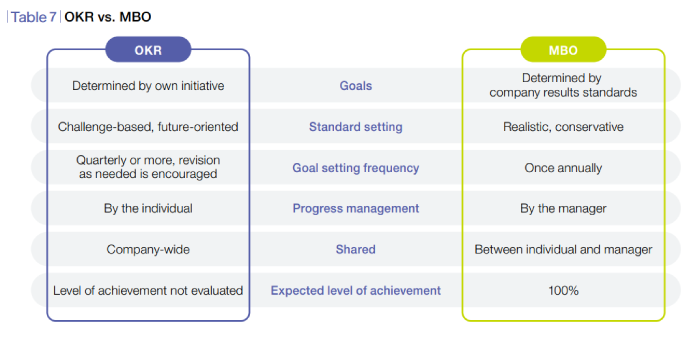

In addition to providing these opportunities, we introduced Objectives and Key Results (OKR) as a professional management system whereby each person can exercise discernment and make an independent contribution towards achieving the aims of the whole of i-PRO and the division with which they are affiliated. OKR was developed at Intel and has produced great results at start-up companies including Google, recently gaining much attention. Under OKR, we set objectives for realizing our vision, and key results that indicate specific standards and initiatives for achieving these objectives. Even at i-PRO, everyone from the CEO down sets up, publishes and shares organizational and individual objectives and key results. (See Table 7 OKR vs. MBO.)

OKR resembles but differs from conventional management by objectives (MBO) in that we do not use it in performance evaluations and personnel assessments. Its concept is that using rate of achievement of objectives in evaluations actually has the opposite effect of the original aim of MBO, which is to coordinate objectives of the organization.

At i-PRO, OKR is a tool for individuals to use to motivate themselves. We do not intend it as a means for the company to control the individual. For this reason, the company does not enforce implementation of OKR, entrusting it to the judgment of each division and individual. Naturally then, the company does not caution or discipline divisions or individuals who feel they do not need OKR. It is up to the individual themselves if they choose to set OKR and implement the system to tackle challenging goals, or if they use their own system. In other words, as professionals, they are expected to think and act by themselves, including whether or not they set OKR. Actions and results are reflected in evaluation by colleagues both directly and indirectly. Everything is evaluated by the market.

Next, I will introduce my own objectives, that is, the i-PRO Corporate Objectives.

i-PRO Corporate Objective 1:

80% of i-PRO’s sales to be comprised of products that were not yet released two years ago.

i-PRO Corporate Objective 2:

80% of i-PRO’s sales to be comprised of products that can be shipped within three days of receipt of order.

i-PRO Corporate Objective 3:

Products developed under the i-PRO Quality Management System have fewer quality defects than products developed under the Panasonic Quality Management System.

I have deliberately avoided sales or profit objectives, which are usually included in MBO. In the event that we realize the above objectives, I am sure that i-PRO will have outstanding achievements. These three objectives are not for financial numerical values. Instead, they indicate the issues that each division and individual should tackle and promote capability enhancement. For example, objectives are not “to win at the athletic meet” or “to come first in the contest.” Instead, they implore people to develop and train themselves continuously day-to-day. Through accumulation of such diligent efforts, one is sure to achieve favorable results at an athletic meet or contest. Perhaps finishing first is not just a dream.

We aim for just such an organization, where professionals can demonstrate the abilities they possess. In the end, the mission of CEO is to nurture talent. I believe that if I can constantly stimulate the organization and its members, to help members see their abilities bloom, and to support that growth, we can become a standout company that rivals cannot catch.

October 2022